Visa Exec Says ‘Opt Out With Bitcoin’ Slamming Fed’s Policy Change Toward Inflation | Finance Bitcoin News

On Thursday, 17 top Federal Reserve officials explained that the committee plans to let inflation run hotter than usual, or above the benchmark 2% rate for a duration of time. Fed Chair Jerome Powell’s speech was considered a “major policy shift” and a number of economists commented on the central bank’s move. Senior director of policy at Visa, Andy Yee, said Powell’s inflation statements were historical and people should “opt out with bitcoin.”

According to the U.S. Federal Reserve, the central bank will be allowing inflation to run up higher than 2% for a period of time.

The Fed also said that it wouldn’t hold a bias toward the labor markets and the central bank will hold to its new policy framework. News.Bitcoin.com recently reported on the Fed’s inflation proposal and how it aims to leverage the economy’s inflation rate.

“The Committee seeks to achieve inflation that averages 2% over time and therefore judges that, following periods when inflation has been running persistently below 2%,” the Fed explained on Thursday. “Appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time,” the central bank added.

Following the Fed’s major policy shift to let inflation run more rampant, a few analysts and economists commented on the central bank’s new direction.

Andy Yee, a senior director of policy at Visa tweeted about the Fed’s latest move to let inflation run hotter than usual. “Jerome Powell’s speech today will be for the history books,” Yee said. The Visa executive continued:

Never in the history of mankind was so much stolen from so many by so few. Opt out with Bitcoin.

On Twitter, the Visa executive Yee has commented on bitcoin on numerous occasions in the past. When CNBC reported that the Fed Chair was set to deliver a “’profoundly consequential speech,” Yee said: “In 2008, Satoshi Nakamoto delivered ‘profoundly consequential’ whitepaper, changing how people view money.”

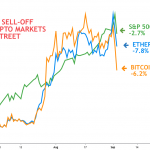

Raoul Pal the chief executive officer at Real Vision also explained on Twitter that he knows that gold and bitcoin have slumped in recent days, but stressed that Jerome Powell’s comments bolster an “inherent upside skew in both assets.” Pal further added:

I think [gold and bitcoin will] rise over time in inflation or deflation. Most people don’t understand the latter but is simply put, Powell has shown that there is ZERO tolerance for deflation so they will do ANYTHING to stop it, and that is good for the two hardest assets – Gold and Bitcoin. Powell WANTS inflation.

Pal also added that he thinks bitcoin will outperform gold during this macroeconomic storm. “Gold can go up 2x or 3x or even 5x, while bitcoin can go up 50x or even 100x,” Pal insisted on Twitter.

A great number of other free market advocates spoke out against the Fed’s manipulation after Powell’s statements. Moreover, the Fed Chair never disclosed what “moderately above 2%” actually means on Thursday.

News.Bitcoin.com also reported on how Robert Kaplan, the Dallas branch Federal Reserve President said it would likely be between 2.25% to 2.5%. However, St. Louis Fed President James Bullard elaborated further on the matter.

“This is a very large committee as you know, with many opinions,” Bullard said during an interview with Bloomberg. “So I don’t think you want to get into precise mathematical formulas here. But the spirit of this is that, in the committee’s judgment, it would be wise to allow inflation to be above targets for some time to make up for past misses.”

What do you think about the Visa executive’s recent statement towards the Fed’s policy change? Let us know what you think in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer