U.S. Senate Debates Digital Dollar; New Mystery Bitcoin Fund Disclosed

Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

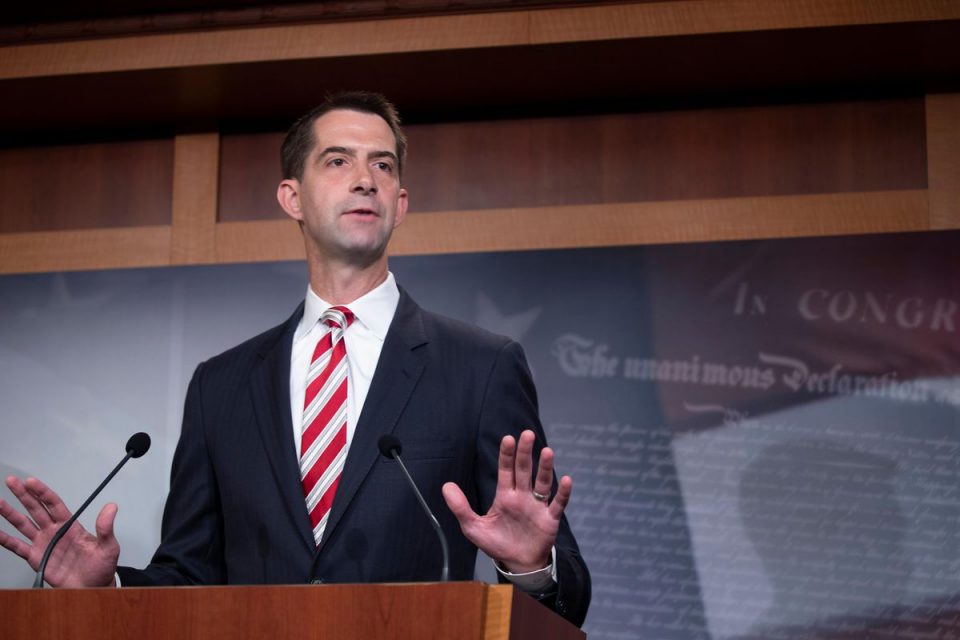

Senator Tom Cotton advocated for the digital dollar as a means to get ahead of China.

Tasos Katopodis/Getty Images

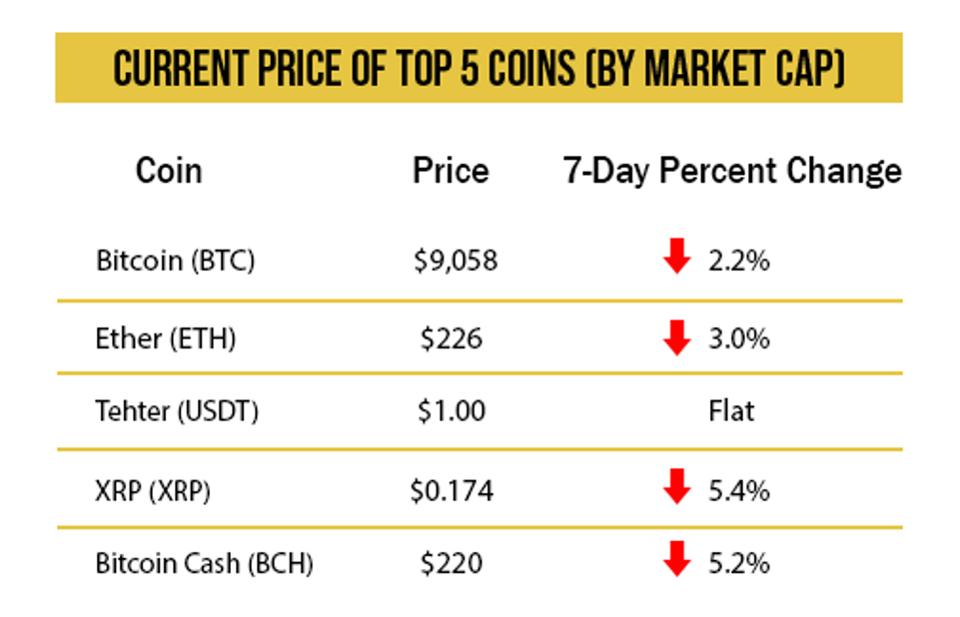

CRYPTO MARKETS

Bitcoin flatlined into the end of 2020’s second quarter with another calm week, hovering just above $9,000. “It is not unusual to see markets trading in a tight range into large quarterly expiries and picking up a direction thereafter,” cryptocurrency analyst Emmanuel Goh says. Trading expert Paul Eisma says crypto markets are in a comparable state now to stocks in the post-dotcom bubble years, as companies regroup and slowly build products for the long term.

The near-term future may be brighter for ether, which is at the forefront of the decentralized finance (DeFi) explosion with platforms that can be built on its blockchain. Specialized DeFi tokens have done even better than bitcoin in the last three months, though a correction in this segment could help bitcoin rally again.

Source: Messari. Prices as of 12:00 p.m. on July 2, 2020.

BLOCKCHAIN ON CAPITOL HILL

The Senate Banking Committee held a hearing on the future of the digital dollar Tuesday, as competition with China is motivating lawmakers to move forward. “The U.S. dollar has to keep earning that place in the global payments system. It has to be better than bitcoin… it has to be better than a digital yuan,” Senator Tom Cotton said. Former CFTC chairman and head of the Digital Dollar Project Chris Giancarlo urged Congress to embrace change, adding that “Darwin said the most adaptable survive.”

There are still some stumbling blocks around privacy, implementation and equity that have to be sorted out before the digital dollar can be launched. But if Congress and crypto proponents are patient and willing to compromise, it might represent the breakthrough acceptance and adoption that advocates have been striving to achieve.

NEW $190 MILLION BITCOIN FUND

The New York Digital Investment Group disclosed in an SEC filing Tuesday that it closed a $190 million bitcoin fund with 24 unnamed investors. It closed a similarly-named bitcoin fund at $140 million in May, making NYDIG quietly one of the largest institutional investors in bitcoin in the U.S. NYDIG is staying mum on any details about the new fund.

‘DEMOCRATIZING DATA’

On Thursday, CoinMetro became the first crypto exchange to offer market sentiment data used by hedge funds to all of its users. Investor sentiment is the primary catalyst for crypto price movements, and CoinMetro’s integration with analytics company The TIE could give its users an edge. “This data would usually not be available for the little guys…. we feel they have a right to it,” CoinMetro CEO Kevin Murcko says.

ENTERPRISE

Beijing-based ChinaNet Online Holdings said this week that its blockchain projects previously expected to be completed by May of this year were delayed by coronavirus. It entered contracts in 2018 with ethereum startup OMG and a small company called Bo!News to develop and adjust blockchain-powered applications to improve the efficiency of transactions, but with first-quarter revenue nearly chopped in half due to the pandemic, those initiatives were thrown off course.

Elsewhere in the Eastern Hemisphere, one of Australia’s oldest institutions—its post office—will start allowing customers to buy bitcoin and other cryptocurrencies at 3,500 locations.

And Curv, a promising New York-based startup that offers crypto custody services to institutions, raised a $23 million Series A funding round, with Coinbase Ventures among its investors.

COVID AND CYBER CRIME

Ransomware may be the first scalable cryptocurrency threat, but hackers, like employees who have settled in to a new remote working reality, are also in a state of transition. There hasn’t been a significant uptick in cybercrime yet, but information security executive Jason Ingalls says “the bad guys are off doing their research to identify our most vulnerable points. A wave of attacks is coming.”

Hospitals in particular need to have their guard up. “When a hospital’s records are held hostage, lives are put in danger. They are more likely to pay,” Maddie Kennedy of Chainalysis says. So what can we do? Stay vigilant. Don’t click on that phishing link.

ELSEWHERE

Someone Mysteriously Sent Almost $1 Billion in Bitcoin [Vice]

The Man Who Tokenized Himself Gives Holders Power Over His Life [CoinDesk]

Investing in Blockchain Gaming: Why VCs Are Betting Big [Cointelegraph]