Report: Russia Remains a ‘Key Market for Crypto,’ Commands the 3rd Largest Bitcoin Hashrate in the World | Emerging Markets Bitcoin News

The fervor for cryptocurrency assets in Russia has grown wild over the last few years. This week Xangle Research published a comprehensive report about digital currencies and the Russian environment in 2020. The study’s findings show that Russia is one of the world’s key players when it comes to the crypto economy, but finding reliable information about the subject is “not very easy to find,” researchers stress.

It’s safe to say that Russia is one of the regions in the world where cryptocurrency adoption is booming, but it’s hard to verify the regulatory climate in the area.

A recently published study from Xangle Research explains that the country is a hotbed for crypto in 2020. The research also quotes Binance CEO, Changpeng Zhao (CZ) who has said: “Russia is our key market, one of the most active markets in the global blockchain space.”

The Xangle Research report is a comprehensive look at the crypto economy’s relationship with Russia this year, and the author also highlights that the region is a “key market for crypto.”

Two of the biggest sectors in Russia that currently fuels the crypto environment is mining and trading. Demand for crypto trading is high,” Xangle’s report notes.

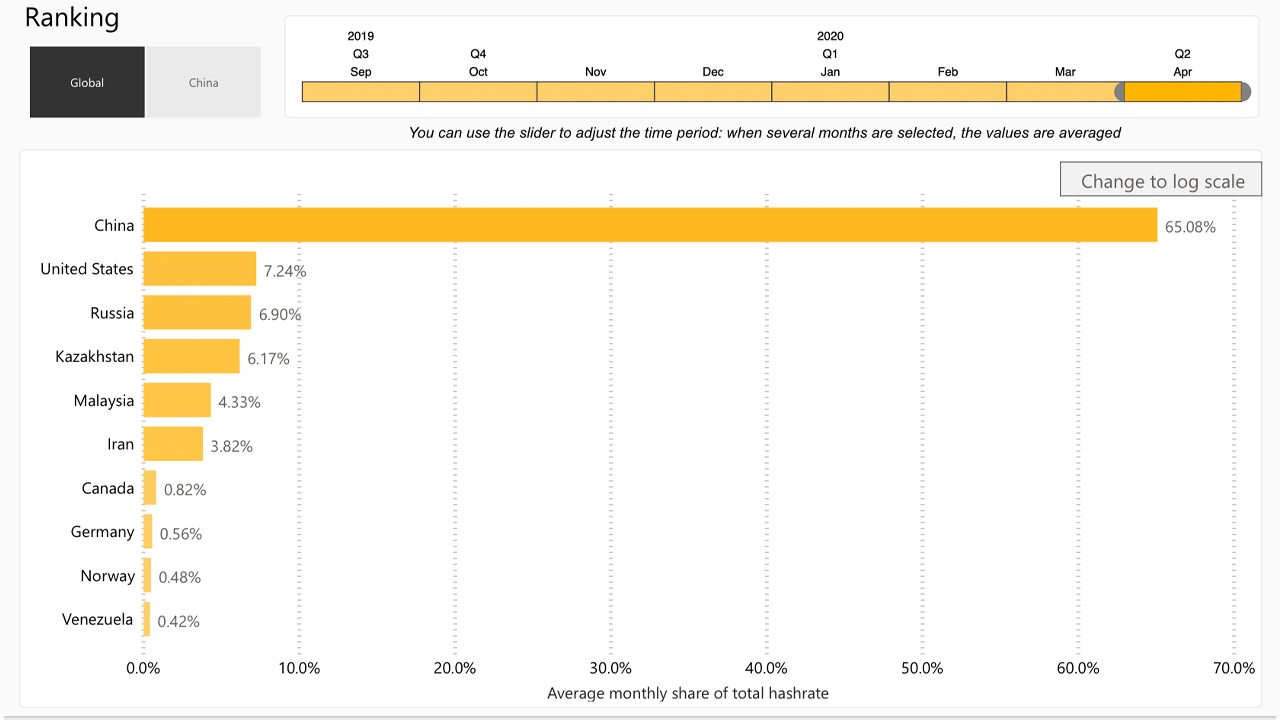

“Russia [also] owns the [third] biggest BTC mining power (hashrate) in the world: 6.9% comes from Russia as of April 2020, according to Cbeci.org,” the study highlights.

Additionally, the 2020 crypto report covering the country says a “large portion of the traffic to major crypto exchanges come from Russia.” Xangle’s stats show that Binance captures most of the Russian traffic and the trading platform is followed by Coinbase, Bithumb, and Kraken respectively.

“Crypto derivatives exchanges are also very popular in Russia,” the study reveals, disclosing the two most popular platforms include Bitmex, and Bybit.

Digital currency exchanges that offer ruble fiat on-ramps have some of the highest Russian internet traffic.

Trading platforms such as Binance, Okex, and P2pb2b have RUB as a fiat-on-ramp, and some of the top sources of traffic as well. Despite the large internet traffic, the ruble is “not actively used in trading” as it only represents a market share of “less than 0.3%.”

The Xangle Research report also mentions some of the regulatory climate in Russia concerning digital currencies. The study discusses the recent law that will come into force on January 1, 2021 signed by Vladimir Putin, which gives legal status to cryptocurrency.

Further, the report also mentions how the largest bank in Russia, Sberbank, is considering the creation of a stablecoin.

“We probably may issue a stablecoin on the basis of the law that has been adopted recently. As we can peg this stablecoin to the ruble, this token could become a basis or an instrument for settlements involving other digital financial assets,” Sergey Popov, the director of transaction business at Sberbank told the media this year.

Despite the law’s crypto recognition, Xangle researchers highlight that the cryptocurrency law Putin signed still prohibits the use of crypto as a means of payment in Russia.

Among a number of luminaries, experts, and politicians quoted in Xangle’s 17-page study, the authors also quote Putin’s recent statements.

“The Central Bank of the Russian Federation considers cryptocurrency neither a means of payment nor a store of value,” the Russian President’s statement says at the end of Xangle’s Russian crypto study. “Cryptocurrency is not backed by anything. One should treat it cautiously, carefully,” Putin stressed.

What do you think about the Xangle Research report called “Crypto Asset Market: Russia in 2020?” Let us know what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Xangle Research

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer