Whether or not the Federal Reserve eventually cuts interest rates to negative levels, it might be a case of heads: bitcoin wins, tails: bitcoin wins.

So far this year, the Fed has created about $3 trillion of new money, an amount equivalent to more than 70% of the total assets created since its founding in 1913. The question now is what the Fed will do next if the economy fails to recover quickly from the devastation of the coronavirus and markets enter a new tailspin.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

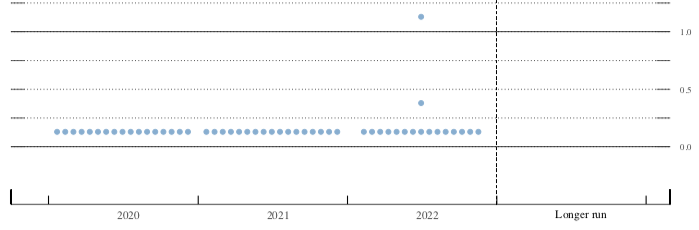

One strategy Fed officials led by Chair Jerome Powell say they won’t pursue? Cutting benchmark interest rates below zero. In a summary of economic projections published by the Fed last week, not a single official projected negative rates.

Cryptocurrency analysts have said negative rates are merely a form of ultra-loose monetary policy, which should eventually push inflation higher. That could be a catalyst for higher prices for bitcoin, seen as a hedge against inflation similar to gold.

But bitcoin might trade higher even if the Fed rejects negative rates outright – since the U.S. central bank would instead probably just inject trillions more of freshly-created dollars into the financial system. “Reluctance to go negative means more QE reliance,” said Marc Ostwald, chief economist at London-based ADM Investor Services.

The Fed’s money injections in response to the coronavirus crisis have helped push up bitcoin prices by 30% so far this year on speculation that inflation will eventually arrive.

“Extremely accommodative policy is bullish for bitcoin,” said Rich Rosenblum, founder of cryptocurrency trading firm GSR.

The Fed is already injecting about $120 billion a month into the financial system by purchasing U.S. Treasuries and mortgage-backed securities, and the pace would likely increase if markets suddenly turned lower.

Former Fed Chair Ben Bernanke, who pushed the central bank into the money printing exercise known as quantitative easing, or QE, in the wake of the 2008 financial crisis, has argued the practice can substitute for further rate cuts.

“Quantitative easing and forward guidance can provide the equivalent of about three additional percentage points of short-term rate cuts,” Bernanke said in January.

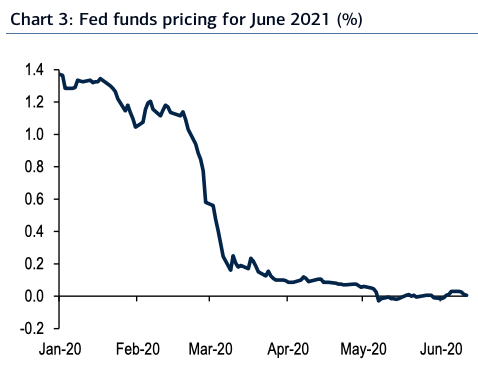

Federal Reserve officials have faced questions about the potential for going negative after they slashed benchmark rates close to zero in March.

As recently as this month, according to Bank of America economists, traders in the market for futures contracts on the Fed’s main interest rate were betting that the central bank might go negative as soon as 2021.

Negative rates have attracted increasing attention among foreign central banks, including the Bank of England and European Central Bank. The Bank of Japan’s main short-term lending rate is already negative, at -0.1%.

An economist with the Federal Reserve’s St. Louis branch even said recently that U.S. monetary policy officials should consider negative rates, to help bring about a sharper and broader economic recovery.

One concern over negative interest rates is they might squeeze commercial banks’ profit margins, since lenders would likely have to reduce rates on loans while struggling to convince depositors to pay banks to hold their savings.

A negative interest rate policy also might force banks to pay interest to the Fed for parking spare cash at the central bank.

“The objection is that financial market plumbing becomes more troublesome with negative rates,” said Michael Englund, principal director and chief economist at Action Economics LLC.

Yet another concern is the convoluted incentives of negative rates might be counterproductive, such as whittling down the monthly incomes of elderly savers who depend on fixed incomes from their retirement savings. That might lead them to spend less, slowing the economic recovery.

“Low rates have winners and losers,” Englund said, such as “punishing senior citizens.”

Ostwald says the Fed might instead adopt a policy known as yield-curve control – where officials establish caps for yields on bonds of varying maturities.

The practice, which typically involves purchasing bonds to keep yields from rising too quickly, is considered yet another form of monetary policy accommodation. Analysts in the market for gold, seen as a traditional inflation hedge, have speculated that yield-curve control could be bullish for the yellow metal.

Rosenblum, at GSR, says negative rates would likely be even more bullish for bitcoin – simply because they’re so unusual, and would be seen by many people as a “strong beacon for something being broken.”

“Printing new money via QE is not as palpable as seeing a negative interest rate,” Rosenblum said. “Seeing your savings literally drop by X% each month would be something completely new.”

For bitcoin investors already enjoying gains from the Fed’s ongoing QE, negative rates might just represent an additional source of upside.

Tweet of the day

Bitcoin watch

BTC: Price: $9,540 (BPI) | 24-Hr High: $9,579 | 24-Hr Low: $9,044

Trend: Bitcoin is taking a pause after Monday’s sharp reversal higher from $8,900 to $9,500.

The top cryptocurrency by market value is currently trading near $9,540, having logged a session high of $9,579 during the early European trading hours, according to CoinDesk’s Bitcoin Price Index.

While the recovery has been impressive, the resistance of the trendline connecting the June 1 and 10 highs is still intact. A violation there would imply an end of the pullback from recent highs above $10,400 and open the doors once more to $10,000.

Konstantin Anissimov, executive director at the cryptocurrency exchange CEX.IO, believes strong resistance at $10,000 will not let the bulls through without a fight. The cryptocurrency has failed multiple times in the last two months to keep gains above $10,000.

A notable pullback may be needed to recharge bulls’ engines for a clear move above $10,000. “Without new fundamental growth drivers it will be much easier for Bitcoin’s prices to return to $8,100 levels, build up a foundation for further growth, and only then take another shot at getting past $10,000,” Anissimov said.

The probability of a drop to $8,100 would increase if prices find acceptance under $8,900. That would invalidate the strong dip demand signaled by Monday’s long-tailed bullish hammer candle.

Prices may also fall if the global equity markets again drop sharply on coronavirus fears. Bitcoin’s positive correlation with stocks has strengthened in the last few days.

From a technical analysis standpoint, Monday’s bullish hammer candle has established $8,900 as the level to beat for the bears.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.