Crypto Market Update for 21 August 2020: $BTC, $ETH, $LINK, $OMG

This article provides an update on the cryptoasset market, with a particular focus on the following digital assets: Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), and OMG Network ($OMG).

To give you a rough idea of how well the crypto market is doing today, 17 of the top 20 cryptoassets (by market cap) are currently in the green (i.e. up against USD). All market data used in this article was taken from CryptoCompare around 09:55 UTC on 21 August 2020.

Bitcoin (BTC)

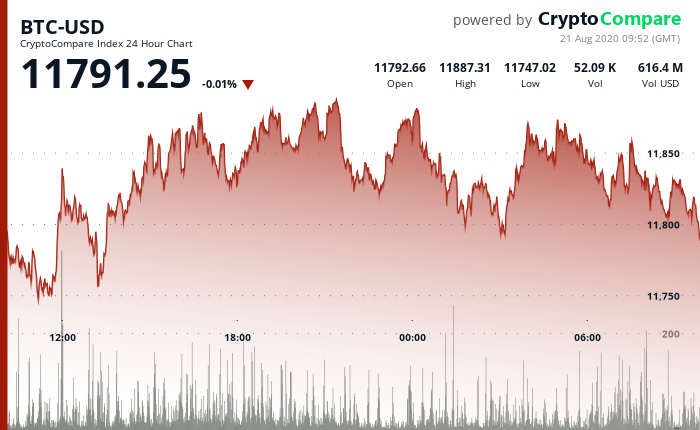

Except for Monday (August 17) when the Bitcoin price reached an intraday high of $12,474, Bitcoin has mostly been trading in the range $11,700–$11,900 for the past week.

Bitcoin’s recent volatility has been so low that Binance Co-Founder and CEO Changpeng Zhao (aka “CZ”) tweeted yesterday that Bitcoin is almost behaving like a stablecoin:

Later on the same day, Tyler Winklevoss, Co-Founder and CEO of digital asset exchange Gemini, said that such low price volatility suggets to him that Bitcoin is getting ready for a big breakout:

Joe Weisenthal, the executive editor of news for Bloomberg Digital, sent out a tweet on Thursday (August 17) that suggested he believes Bitcoin seems to be showing a high positive correlation to gold, thereby supporting the “digital gold” narrative:

Bitcoin is currently trading around $11,791, down 0.01% in the past 24-hour period. Bitcoin’s return on investment (ROI) for the year-to-date (YTD) period is +64.15% vs USD.

Ethereum (ETH)

Over the past 24-hour period, Ethereum has been trading in the range $406.83–$419.09; currently, it is trading around $409.06, down 0.38% vs USD in this period.

Although the Ethereum price only went up 2.75% in the past two-week period, Ether’s return on investment (ROI) for the past 30-day period is +67.14 and its year-to-date (YTD) period is +217.27% vs USD.

Scott Melker, a crypto analyst/trader at TexasWest Capital, remains bullish on Ether due to the huge amount of interest in trading of ERC-20 tokens on decentralized exchanges:

Oj Thursday (August 20), stablecoin issuer Tether moved $1 billion in USDT from the TRON blockchain to the Ethereum blockchain:

<!–

googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1554203714474-0’); });

–>

Alex Saunders, Founder and CEO of Nuggets News believes that this move by Tether is due to the fact that on Wednesday (August 19), USDT’s integration with Ethereum layer 2 scaling solution OMG Network (OMG) went live.

Chainlink (LINK)

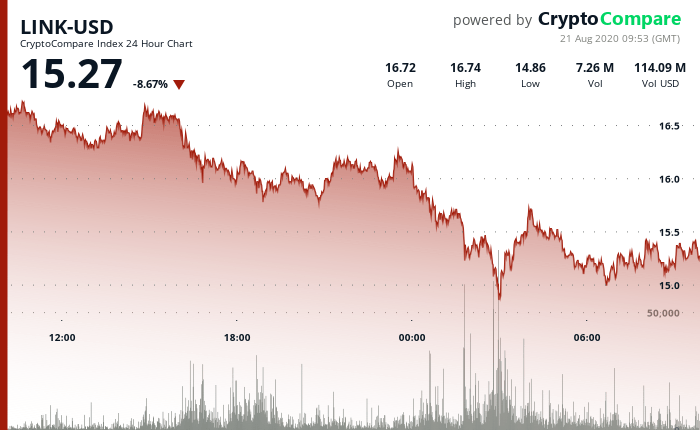

Chainlink’s native token is currently trading around $15.27, down 8.67% in the past 24-hour period.

This means that Chainlink has fallen around 15% since Dave Portnoy, the founder and president of Barstool Sports, bought $50,000 worth of LINK tokens on Thursday (August 13) with the help of the Winklevoss twins. The good news is that LINK is still up 767.61% vs USD so far in 2020.

In the past couple of days, Chainlink has announced two new partnerships:

OMG Network (OMG)

Tether published a blog post on Wednesday (August 19) that announced that the USDT integration with the OMG Network had gone live.

It also mentioned that USDT holders would benefit from this integration since they will be able to make faster payments at a lower cost than with Ethereum but without the need to comprise on security.

Crypto exchange Bitfinex first announced its plan to integrates Tether (USDT) on OMG Network for “faster, cheaper transaction” on 1 June 2020.

Just before Tether and OMG Network announced (around 13:30 UTC on August 19) that the USDT integration had gone live, OMG was trading around $3.319.

Currently, OMG is trading around $6.44, which means that since the announcement, the OMG price has gone up 94.03%, with 72.84% of the gain coming in the past 24-hour period.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.