Britain’s Central Bank Governor Andrew Bailey Snubs Bitcoin

For those who watched the Brookings webinar that hosted Britain’s Central Bank

CPF

Governor Andrew Bailey for a webinar on crypto assets, stablecoins, and central bank digital currencies, there was no subtly in how he felt about each of these digital asset categories. When it comes to the discussion of whether Bitcoin could play a role as either a store of value or for payments, his comments were bloody, in both the American and English interpretations of the word.

“Let me start with crypto assets such as Bitcoin which have appeared in the last ten years. They don’t have any connection to money at all…their value can fluctuate widely unsurprisingly. They strike me as fundamentally unsuited to the world of payments where a certainty of value matters,” said Bailey.

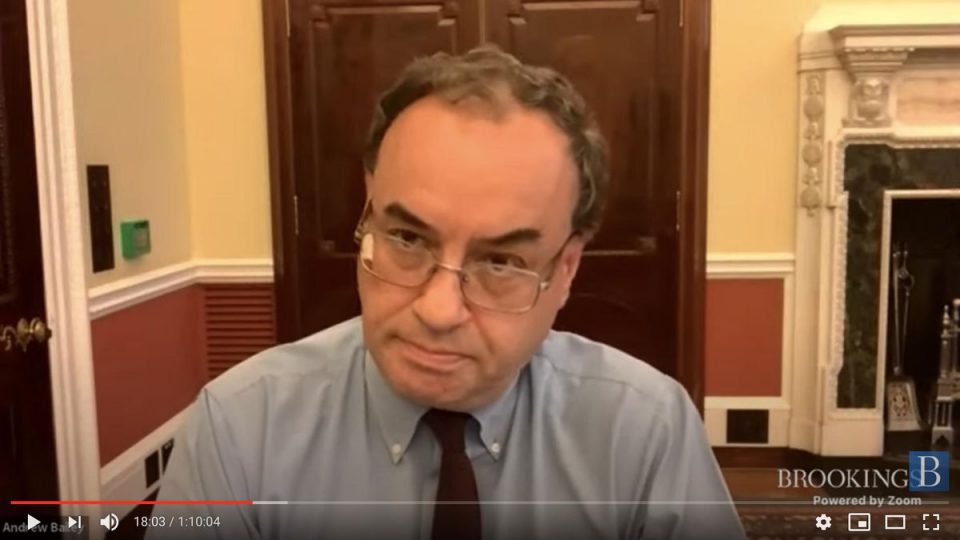

Britain’s Central Bank Governor Andrew Bailey giving a speech virtually at a Brookings event on … [+]

Brookings

Without missing a beat and so that you would not mistake a touch of British humor was present, Bailey moved right along to what he felt might actually be the future of money. And, as if cryptocurrency was an eight-track tape, the innovation that Bailey envisioned could be the ‘Beats headphones’ of digital currencies were stablecoins, possibly operating alongside a future central bank digital currency.

As if John Lennon was about to perform ‘Twist And Shout’ before the Queen and told the Bitcoin and altcoin ‘cheap seats to clap your hands’, Bailey implied you could enjoy the ‘rock and roll’ aspect of digital currency by ‘rattling your jewelry’ with some stablecoins in your digital wallet.

Stablecoins “could offer some useful benefits,” hinted Bailey, “…once ‘consumers can use them with confidence.” The benefits of stablecoins suggested by the Governor were to, “further reduce frictions in payments by increasing speed and lowering cost of payments,” as well as offering the, “convenience of integration with social media platform or retail services,” said Carney.

Bailey made clear the tune for stablecoins must start as a simple one, and at times it almost felt like his speech was directed at Facebook’s Libra. In that he was at a Brookings Institute event and addressing a mainly American crowd, where Facebook calls home, Bailey seemed to caution CEO of Facebook Mark Zuckerberg not to move fast and break things when it comes to money. Bailey declared, “[A] starting point for stablecoins should be based on single currencies. Let’s not run before we can walk.”

Logo of Libra digital currency displayed on a phone screen and a keyboard are seen in this multiple … [+]

NurPhoto via Getty Images

Bailey then clarified that the wrong question in where most people would see this going, that Libra’s move to only do single currency stablecoins at the start, was not indicating that a multi-currency stablecoin from Libra would be out of the question, as least from the UK’s vantage point. The secret that Bailey alluded to that was critical in how stablecoins could participate in the global economy was about the critical importance of determining the standards. “But if stablecoins are to be widely used as a means of payment, they must have equivalent standards to those that are in place today for other forms of payment types,” said Carney.

And if the Beatles are just not your type of rock and roll, Carney suggested option #3, although of course the Bitcoin option #1 was a non-starter while option #2 held promise. Bailey laid out the idea of central bank digital currencies (CBDC), as if instead of a band, all you needed for your digital entertainment was the currency of a ‘King’, whether that would be Elvis Presley or, in the current scenario, the ‘Queen’ of England’s currency in digital form.

As to whether Carney felt it was time for Her Majesty’s Digital Sterling to start ‘cryptographic’ printing from the Royal Mint, and whether a CBDC was an inevitable and clearly the safest outcome, Bailey said, “I think the answer to that is yes and no. It’s a good question, and it is being considered and it should be, but it’s a big one and the answer is not yet either.”

Pound sign on digital background

getty

Carney complemented the Brookings paper on design choices for central bank digital currency that was recently published, noting the design would be critical in terms of interoperability of CBDC across borders as well as private stablecoins. Carney noted that the Bank of England would be sending out more information next year as a follow-up to a Discussion Paper on CBDC issued earlier this year, he described stablecoins and CBDC might sit alongside each other, depending on the design options.

For the final number of this virtual British invasion in the U.S. when it comes to digital currency, Carney waxed philosophical when he concluded his thoughts by saying, “[The] changing nature of money causes us to pause and consider the implications of money much further than a simple exchange of money or value transaction…policy implications are much greater as to the specific mission of the central bank…where might the role of the central bank might start and stop.”

Carney further noted that in terms of issues of privacy around using a digital currency was beyond his pay grade – or any central banker’s for that matter – as a wider debate when shifting to digital currency in terms of balancing the detection and prevention of financial crime with the risk of surveillance. His recommendation in terms of how this innovation has raised the question to the heart of how we use money and who should be responsible involves a wider debate between governments and society as a whole.

In understanding the “bounds” of where a central banker fits into the picture and the role a central bank plays in society, besides his feelings on Bitcoin, Carney concluded by saying the “cycle of innovation is such that it is essential we set standards”.

Disclosure: The Value Technology Foundation commented on the Discussion Paper issued by the Bank of England in regards to CBDC.