Bitcoin’s Surprising Selloff; Is Satoshi Cashing Out?

Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

Getty Images

CRYPTO MARKETS

Amid speculation that bitcoin’s enigmatic creator Satoshi Nakamoto might be selling, bitcoin slumped into the holiday weekend, falling more than 10% from its weekly high to less than $9,000 on Thursday. Forty bitcoins which were mined only a month after the cryptocurrency’s origin in 2009 changed hands for the first time, scaring investors who believe a handful of early whales—the anonymous Nakamoto and his inner circle—are sitting on billions of dollars worth of bitcoin.

“While it is unclear if it was Satoshi Nakamoto, it is likely to be a very early-stage adopter of the crypto-asset, and the timing of the rumors themselves appear to be the source of yesterday’s flash crash,” market analyst Adam Vettese wrote to clients.

Not all insiders are shaken. Venture capital firm Andreessen Horowitz, which announced a $515 million crypto fund last month, envisions the possibility of a “fourth crypto cycle” soon that could send bitcoin’s price to new highs. And Federal Reserve chairman Jerome Powell’s comment last weekend that “we’re not out of ammunition by a long shot” highlighted bitcoin’s value proposition for some who fear inflation during the ongoing economic crisis.

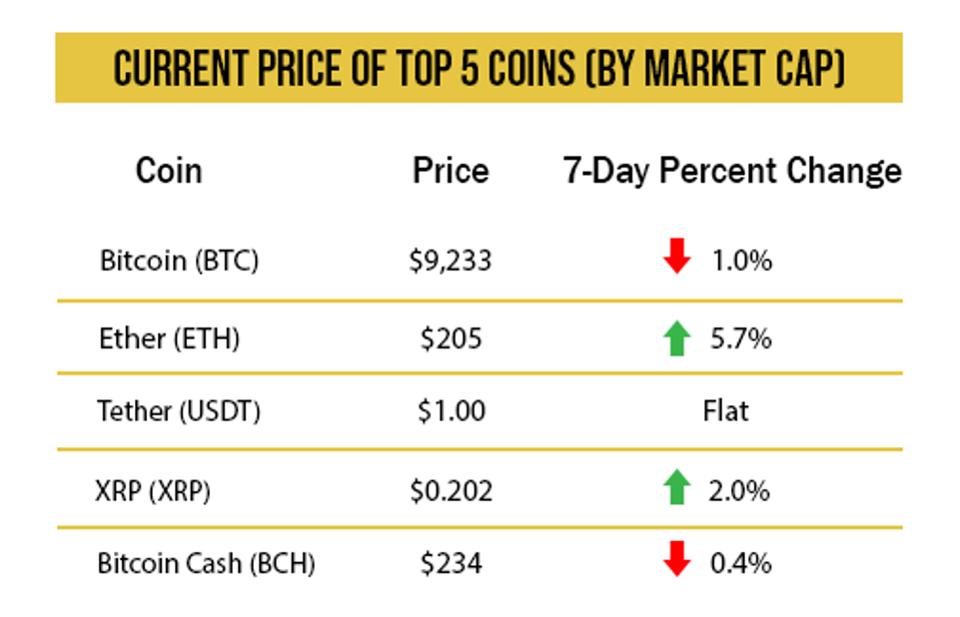

Source: Messari. Prices as of 12:00 p.m. on May 22, 2020.

TWO-PRONGED PROFITS

Thanks to the cheap power near the abundant natural gas and wind turbines in West Texas, Layer1, a startup backed by billionaire Peter Thiel, can produce bitcoin at just $1,000 per coin, making 90% profit margins at its current price. But CEO and co-founder Alex Liegl is prepared to temporarily shut down the mining operation this summer. Why? Because he can also make a windfall by transferring his energy to the electricity grid to meet excess demand for air conditioning during the dog days of summer.

Just for its willingness to shut down bitcoin production, Layer1 collects an annual premium correlated to expected power demand that’s worth about $17 million.

FULL COURT WORDPRESS

Ripple-backed blockchain startup Coil announced an integration with WordPress, a popular blogging platform used by tens of millions, that could allow website creators to receive blockchain-metered payments in XRP. The deal isn’t directly tied to any site using WordPress yet, and the jury is still out on whether it will work at all, but in a best-case scenario, it’ll allow readers to protect their data and give content creators an alternative to ad-based revenue streams.

CENTRAL BANKS’ INFLUENCE

Central bank digital currencies might not have been the original idea of blockchain and crypto, but their continued development is good news for mainstream blockchain adoption. Although the idea of tethering a cryptocurrency in some way to an existing fiat currency, at the core of most proposals, seems to be a betrayal of the decentralization crypto was supposed to represent, it presents a path to circumvent the obstacles in the way of broader adoption.

That sort of adoption may still be years away, but central banks are also helping decentralized currencies in the short term with their response to the coronavirus pandemic. From the U.S. to Europe, Japan and China, countries are printing money to counter unprecedented unemployment. Inflation might be on the horizon.

DEATH OF A CRYPTOCURRENCY

Under intense pressure from the SEC, messaging app Telegram disbanded its crypto project. After two and a half years of development and several setbacks when federal regulators came knocking, the SEC prohibited distribution of its proposed grams not just in the U.S., but internationally. The decision forced Telegram CEO Pavel Durov to throw in the towel, but he made clear in an essay that his advocacy for decentralization in finance will continue.

“This battle may well be the most important battle of our generation,” he concluded. “We hope that you succeed where we have failed.”

ELSEWHERE

As Bitcoin Halving Dust Settles, Network Awakens to Costly New Reality [Cointelegraph]

Square Unveils Bitcoin Auto Payments Tool [CoinDesk]

The biggest threats to Bitcoin in 2020 [Decrypt]