Bitcoin clocked highs near $9,600 Tuesday morning, having trapped bears on the wrong side of the market with a brief dip below $9,000 on Monday.

Analysts say a risk reset in the traditional markets fueled bitcoin’s rise from $8,900 to $9,580 in the last 24 hours. “Bitcoin has regained poise, possibly tracking the recovery in global stock markets,” said Asim Ahmad, co-chief investment officer at London-based Eterna Capital.

Major European equity markets are reporting gains of over 2% at press time, while futures tied to the S&P 500 are up 1.2%, according to Investing.com. The situation was different 24 hours ago when S&P 500 futures were down 2% due to renewed fears over the economic effects of the coronavirus pandemic.

Sentiment on Wall Street turned positive during yesterday’s U.S. trading hours after the Federal Reserve announced it would start buying yet more corporate bonds. The S&P 500 ended the day with a 0.83% gain. The risk appetite improved further during Tuesday’s Asian hours after Bloomberg reported the Trump administration is preparing a near $1 trillion infrastructure proposal.

The turnaround in the global equities likely helped bitcoin rise back to $9,600. In the past, the cryptocurrency has closely followed traditional markets during bouts of coronavirus-induced panic.

Most notably, the cryptocurrency crashed from $10,000 to $3,867 in the first half of March, as stock markets cratered at the prospect of a coronavirus-induced recession. In the following five weeks, both stocks and bitcoin witnessed solid recovery rallies.

At press time, bitcoin is changing hands near $9,550, representing a 1% gain on the day. While the unprecedented stimulus programs are widely expected to bode well for bitcoin in the long run, in the short-run, the cryptocurrency remains vulnerable to losses in stock markets.

Prices may fall again fall back to $9,000 in the next 24 hours if the stock markets lead the way lower. Fed Chair Jerome Powell is likely to present a dour outlook on the economy during his semi-annual policy report on Tuesday and Wednesday.

The Fed said last Wednesday the economy would take years to normalize, dashing hopes for a V-shaped recovery.

From a technical analysis perspective, a clear break above $10,000 is needed to confirm a bullish breakout. The bulls have persistently failed to keep gains above that level over the past three months.

“Bitcoin has been flirting with the $10,000 mark since May but has since been coming back down,” said Vijay Ayyar, Asia head at cryptocurrency exchange Luno. “This is what is typically known as ‘distribution’, where a lot of the gains made in the past few months by large traders are sold into weaker hands.”

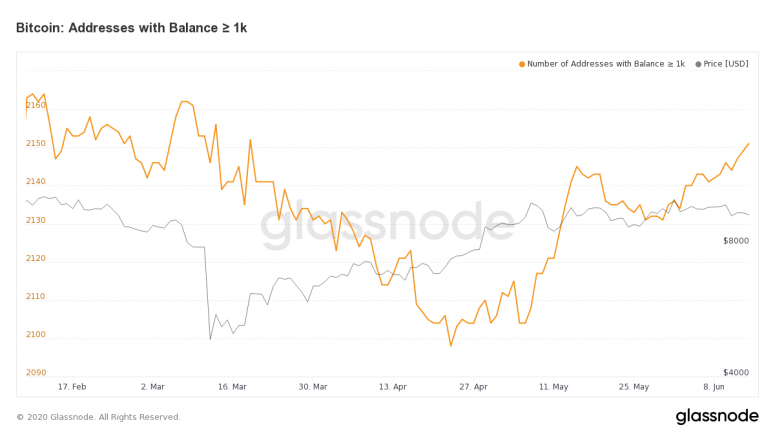

The psychological $10,000 barrier, however, may soon be breached as larger investors seem to be accumulating bitcoin.

As of Monday, there were 2,151 addresses with balance more than 1,000 BTC, the highest since mid-March, according to data from Glassnode. The so-called bitcoin “rich list” has increased by nearly 3% over the past two months.

A convincing move above $10,000 would likely yield a stronger rally to resistance lined up at $11,950 (September 2019 high). Meanwhile, on the downside, $8,500 is a key support. “If that level is breached, prices could decline to the levels we saw in the crash in March: $7,700, and then $7,100,” said Ayyar.

Disclosure: The author holds no cryptocurrency at the time of writing.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.