Bitcoin Price Surges to $7,200 — Here’s What Top Traders Think Is Next

The sentiment of top traders on the short-term trend of the Bitcoin price remains mixed after BTC surged by more than five percent within less than six hours from $6,840 to $7,200.

Some prominent traders believe that the Bitcoin price could range between $7,700 and $7,300, grinding upwards to the low-$8,000 region. Others foresee a steep rejection in the $7,700 to $7,900 range, which has been a historically strong area of resistance.

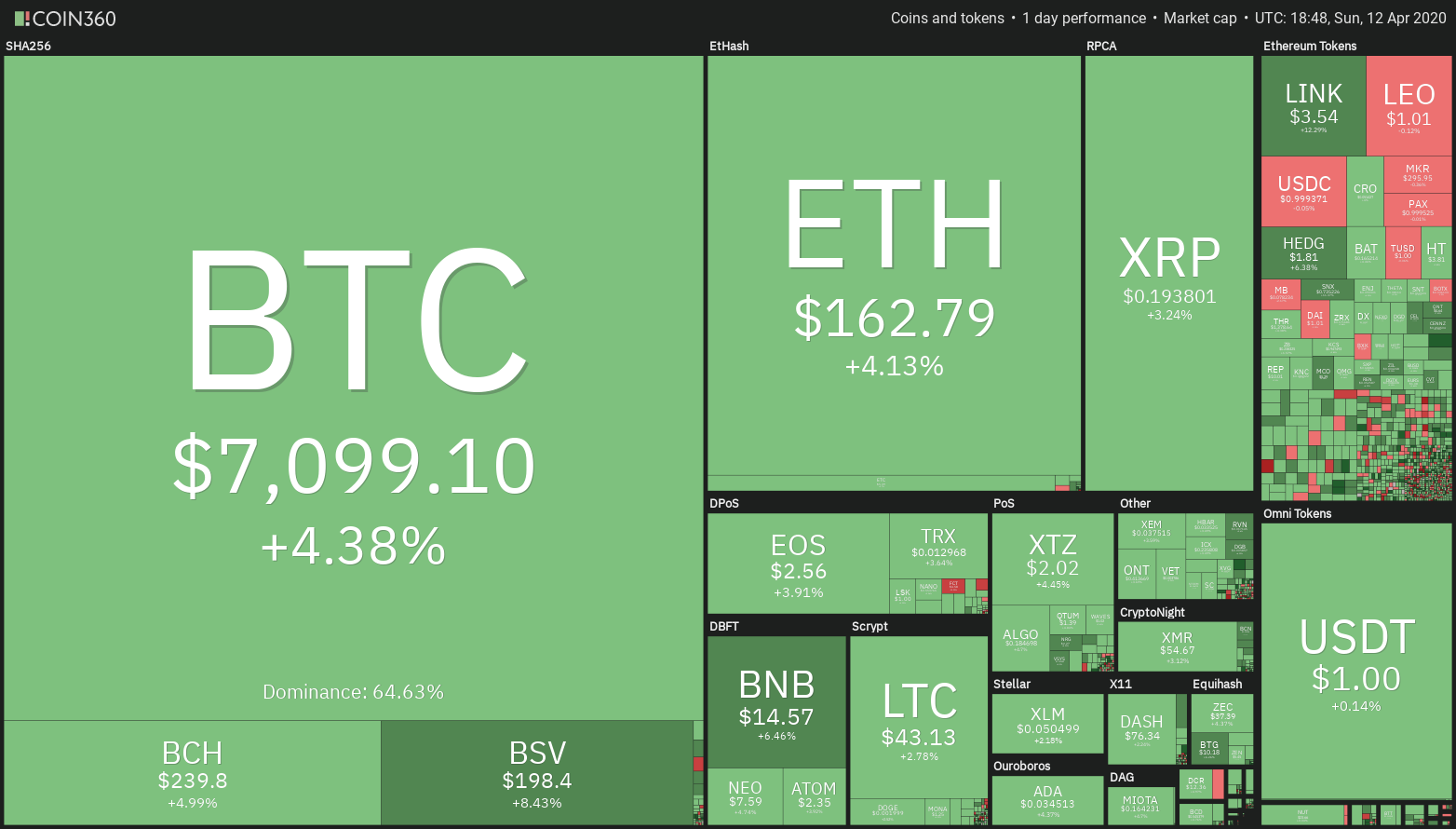

Crypto market daily performance. Source: Coin360

Generally, Bitcoin traders see $7,700 next for BTC

The majority of top traders are seemingly convinced that Bitcoin price is likely to test $7,700 in the near-term.

BTC is currently hovering at its yearly open, and an upsurge to $7,700 would allow the dominant cryptocurrency to test a crucial reversal point that triggered the rally to $10,500 earlier this year.

When Bitcoin portrayed an unclean inverse head and shoulders pattern in December 2019, the $7,700 level served as the neckline of the entire formation. Eventually, Bitcoin climbed all the way to $10,500 by February 13, seeing an extended rally.

BTC USD daily chart. Source: TradingView

One trader who operates under the alias Thrillmex said that a CME gap exists at $8,400, which is the same area marked by renowned technical analyst PentarhUdi in early March.

On March 20, when the Bitcoin price was still trading at $5,200, PentarhUdi predicted that BTC is likely to rebound to as high as $8,500, which is an important weekly simple moving average level with historical significance.

PentarhUdi previously said:

“This should bounce up from weekly SMA 200 ($5200) up to daily sma 200 ($8500). Break up of the upper trend line invalidates this bearish count. I remind you this is a hypothetical bearish outcome of previous published ideas.”

The difference in the recent Bitcoin recovery beyond $7,100 is that its upward momentum has been supported with rising volume. Previous rallies saw declining volume, which typically indicate a fakeout.

In the short-term, traders are considering the following four scenarios:

- Bitcoin ranges in between $7,300 to $7,700 before breaking down to the $5,300 Fibonacci level

- Bitcoin grinds upwards to $8,200 following the current ascending trendline

- Bitcoin rejects the $7,700 to $7,900 resistance area to retest lower supports in the $4,000 to $5,000 range

- Bitcoin goes to as high as $8,400 to $9,000, closing the CME gap and a key weekly SMA level

Bears and bulls likely to fight it over next week

The bearish scenario for BTC in the immediate-term is a higher time frame candle, like a weekly candle, closing below $6,900 and resuming the downtrend.

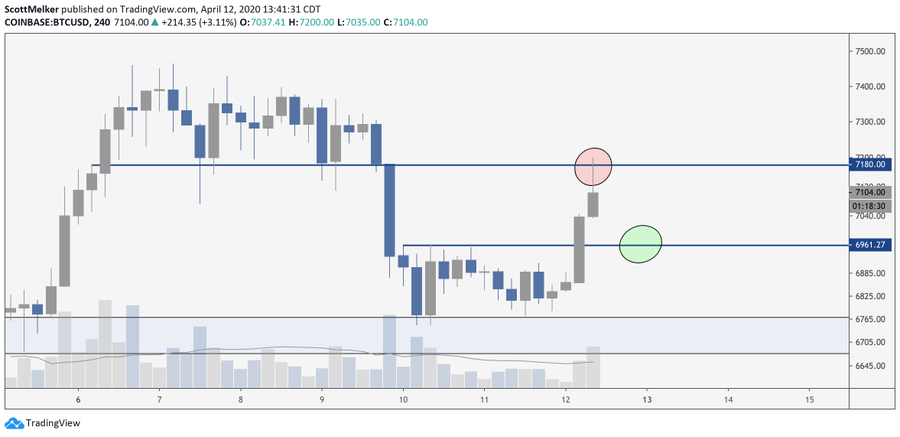

Cryptocurrency trader Scott Melker said:

“If you’re a bear, red was a clear spot to try a short. If you are a bull, a pull back to green looks like a good entry.”

BTC USD 4-hour chart. Source: TradingView

With the price en-route to closing its weekly candle above $7,000, the general sentiment around BTC, at least in the short-term, remains a retest of $7,300 and possibly an extended upsurge to $7,700.

Bitcoin daily price chart. Source: Coin360″ src=”https://dailybitcoinupdates.com/wp-content/uploads/2020/07/23b62c0716eb0ed8f199402b32aa0433.jpeg” title=”Bitcoin daily price chart. Source: Coin360″>

Bitcoin daily price chart. Source: Coin360

As the Bitcoin price pushed higher many of the top-10 altcoins followed suit. Ether (ETH) rallied 4.41%, Bitcoin Cash (BCH) gained 4.57% and Chainlink (LINK) added 12.92%.

The overall cryptocurrency market cap now stands at $201.4 billion and Bitcoin’s dominance rate is 64.2%.