Bitcoin Forecast: BTC/USD Price – Lack of Clear Direction

BTC/USD Price Technical Outlook

BTC/USD – Indecisive Traders

On Wednesday, Bitcoin rallied to a two-week high at $9,474. However, the price declined after and closed the weekly candlestick with a Doji pattern and indicated the market’s indecision at that stage.

The Relative Strength Index (RSI) moved around 50 and highlighted weak bulls and weaker bears.

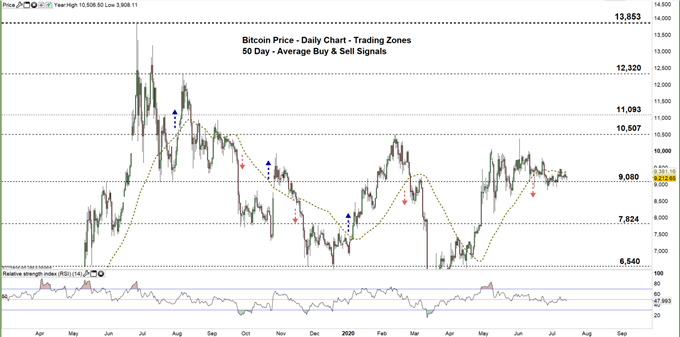

Bitcoin PRICE DAILY CHART (MaR 1, 2019 – July 14, 2020) Zoomed Out

Recommended by Mahmoud Alkudsi

Traits of Successful Traders

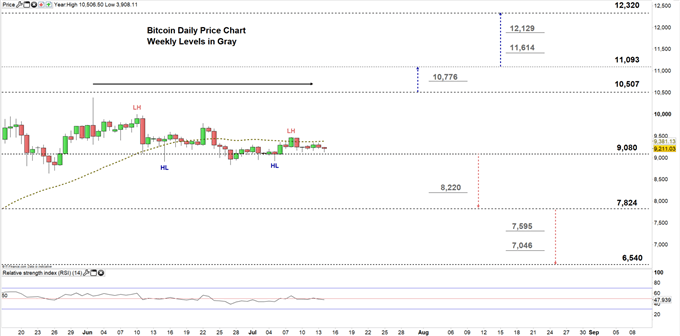

Bitcoin PRICE DAILY CHART (June 20 – July 14, 2020) Zoomed In

On June 10, Bitcoin corrected its upside trend and traded in a sideways move creating a set of lower highs with higher lows. On June 28, the cryptocurrency climbed to the current trading zone $9,080 – $10,507 then failed on multiple occasions to slip to the lower zone. On Thursday the price closed below the 50-day moving average and generated a bearish signal.

A close above the 50-day average could cause a rally towards the high end of the zone, and any further close above that level may embolden bulls to push the market towards $11,093.

On the flip-side, a close below the low end of the current trading zone signals that BTC/USD could fall towards $7,824, and a further close below that level may encourage bears to press the market even lower towards $6,540.

Recommended by Mahmoud Alkudsi

Building Confidence in Trading

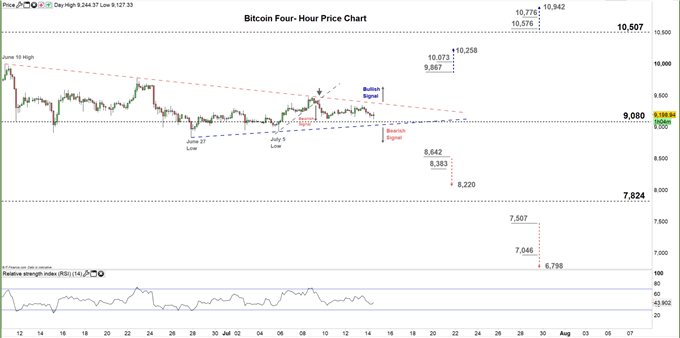

Bitcoin PRICE FOUR Hour CHART (June 9 – July 14, 2020)

On Thursday, Bitcoin traded below the uptrend line originated from the July 5 low at $8,927 and signaled bear’s attempt to control the price action. Hence, a break below the uptrend line originated from the June 27 low at $8,834 would generate a bearish signal, while a break above the downtrend line originated from the June 10 high at $10,002 increases the likelihood of testing the high end of the current trading zone discussed on the daily chart.

Thus, a break below $8,642 could send BTC/USD towards $8,220 while any break above $9,867 may trigger a rally towards $10,258.that said, the weekly support and resistance levels underscored on the four-hour chart should be kept in focus.

Recommended by Mahmoud Alkudsi

Improve your trading with IG Client Sentiment Data

Written By: Mahmoud Alkudsi, Market Analyst

Please feel free to contact me on Twitter: @Malkudsi