August/September 2020 Update

My favorite month (August) is almost over and changes of autumn are already in the air. I hope each of you is having a wonderful summer!

Current Market Conditions

I will keep this month’s update relatively brief, as not much has changed from an economic/investment perspective since the end of July.

The world still remains mired in a COVID-vaccine-is-coming holding pattern while the Federal Reserve and US Treasury continue to prop-up stocks, bonds, and hard assets with very low interest rate policies, easy lending, and rapid expansion of the money supply. Accordingly, income inequality is worsening and savers continue to get rekt (i.e., “ruined”).

The effects on “regular Americans” are completely predictable… and horrible to watch in real time. As the system continues to fail the people, the people are increasingly lashing out against it. Expect more of the same in the ensuing months and years.

For our part, we need to remain vigilant and invest wisely.

Strategies for Vailshire’s Separately Managed Accounts

From last month’s update, “When economic growth is tepid, inflation is accelerating, money supply/credit is expanding, the US dollar is weakening, and volatility remains elevated, the following assets historically tend to perform well:

- Gold miners and royalty companies

- Gold/Silver

- Utilities

- Real estate

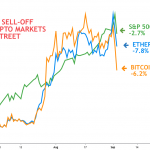

- Bitcoin/Cryptocurrencies

- Technology and other growth stocks

- Treasury Inflation-Protected Securities (TIPS)

- Emerging markets“

Nothing has changed from this previous assessment, so if it ain’t broke, don’t fix it!

Our plan

I continue to believe that the above-mentioned sectors/assets will outperform the general stock and bond markets… and thus have positioned our portfolios accordingly.

Depending on your investment objectives and individual account investment privileges, Vailshire’s separately managed accounts will be allocated in the following cautiously optimistic, stagflationary manner:

- 20-30% US stocks (skewed towards growth/innovation and mid/large caps)

- 10% Emerging Market stocks

- 20-25% Real Estate

- 2-10% Cash

- 20% Gold and Gold Streamers/Royalties/Miners

- 0-23% Bitcoin/Ethereum (based on personal preference and trading permissions)

- 5% Commodities

If you are a Vailshire Client, feel free to log into your Vailshire-managed account(s) at Interactive Brokers and notice how your own portfolios are positioned! (It’s a good idea to log into your accounts at least quarterly, just to make sure your settings and demographics are up to date.)

As before, if you are not currently holding any bitcoin or ethereum, but would like to consider doing so going forward via SEC-regulated investment trusts (my recommendation), please reach out to me so we can set up your account accordingly and make it happen. Approximately 90% of Vailshire clients now hold some bitcoin in their brokerage accounts via the Grayscale Bitcoin Trust, which is great, but I would love to get that to 100%!

Conclusion

As always, I am bound by Vailshire’s mandate to Grow and Protect my clients’ hard-earned assets to the very best of my abilities. I am very happy to do this day-in and day-out, God-willing, on your behalf!

Our cautiously optimistic, stagflation-leaning portfolios continue to perform quite admirably while the world watches major geopolitical and macroeconomic events unfold.

I remain confident that the next 12-24 months will provide interesting and highly satisfactory returns for my clients.

Investing wisely with you,

Jeff

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.