BTC Price Outlook: Bitcoin Chart Coiled, Pennant Breakout Eyed

BITCOIN FORECAST: BTC PRICE ACTION COILED LIKE A SPRING SET TO SNAP – BREAKOUT TRADE LEVELS TO WATCH

- Bitcoin prices have drifted lower since the advance off of March’s base faded last month

- BTC price action is underpinned by a Bollinger Band squeeze and potential pennant pattern

- The cryptocurrency could be on a cusp of its next leg higher following its recent consolidation

Bitcoin performance is on pace for another strong year with BTC prices trading more than 25% higher since January’s opening level. After succumbing to a sharp selloff alongside practically all asset classes late February and early March, which came amid peak market turmoil induced by the coronavirus pandemic, the price of Bitcoin staged an incredible 100% rally.

Recommended by Rich Dvorak

Get Your Free Introduction To Bitcoin Trading

That influx of Bitcoin buying pressure helped propel BTC/USD back above the $10,000-price level by June, but over the last six weeks, the cryptocurrency has since retraced about a quarter of its latest bullish leg. Owing to the modest pullback, Bitcoin is currently trading slightly above the $9,000-price zone on balance.

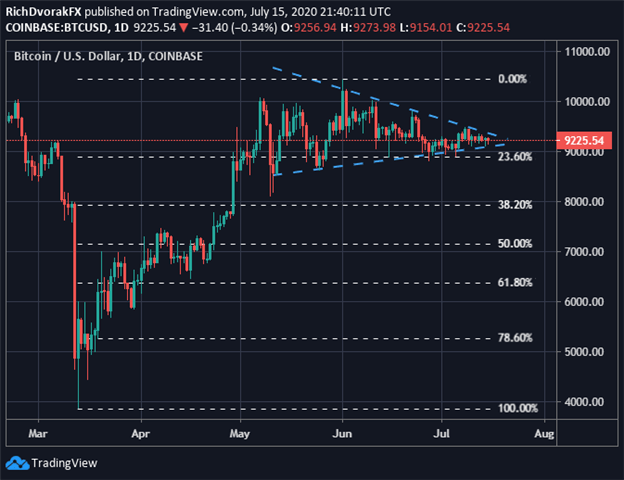

BITCOIN PRICE CHART: DAILY TIME FRAME (20 FEBRUARY TO 15 JULY 2020)

Chart created by @RichDvorakFX with TradingView

On that note, a bullish pennant pattern might have developed from the recent consolidation in BTC price action. Pennant chart patterns are formed by a string of lower highs and higher lows as price coils into a tightly-wound spring. Pennants often take shape after big directional moves and potentially indicate the onset of broader trend continuation.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -2% | 7% |

| Weekly | 31% | -21% | 23% |

BTC prices now approach a ‘break of necessity’ due to the convergence of bearish and bullish trendlines, which are identified by a series of lower highs and a series of higher lows recorded since May 10. Seeing that pennant pattern breakouts can signal trend resumption, Bitcoin might be on the verge of another sharp advance, particularly if the crypto can surmount its negatively-sloped trendline.

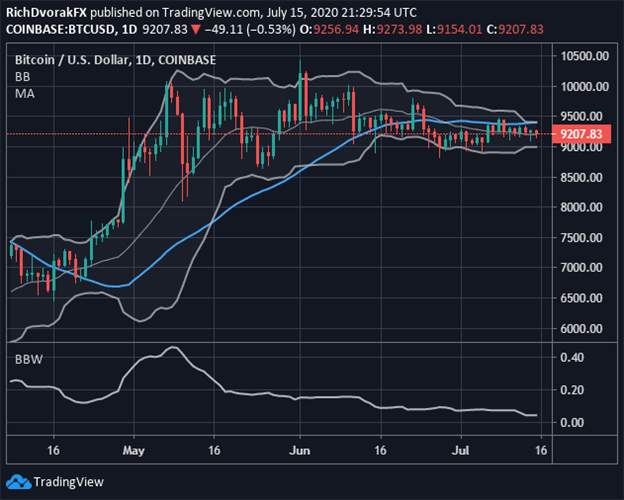

BITCOIN PRICE CHART: DAILY TIME FRAME (08 APRIL TO 15 JULY 2020)

Chart created by @RichDvorakFX with TradingView

Bitcoin prices compressing into a tighter range over recent weeks can be highlighted using Bollinger Bands as well. A Bollinger band squeeze, indicated by declining Bollinger Band width since May 08, echoes the ongoing consolidation in BTC price action. Also, it appears that the lower channel line has provided added technical support to the price of Bitcoin since June 27.

Recommended by Rich Dvorak

Get Your Free Top Trading Opportunities Forecast

This is indicated by BTC prices showing improved buoyancy in relation to the bottom Bollinger Band as daily candlestick wicks remain increasingly contained by the lower barrier on a percentage basis. That said, the 50-day moving average could hinder Bitcoin bulls attempting to push price higher. On the other hand, eclipsing this technical barrier around $9,400 might open the door for a topside breakout toward year-to-date highs, which is a bullish scenario that could garner more credence if followed by a Bollinger Band expansion.

Keep Reading – Bitcoin vs Gold: Top Differences Traders Should Know

— Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight